Assisting Orange County residents on their journey towards financial stability — SparkPoint OC is a financial empowerment program aimed at helping hard-working, low-income residents gain free access to personal financial coaching and resources.

WHAT IS SPARKPOINT OC?

SparkPoint OC helps households create step-by-step personal financial plans to tackle their specific needs – from getting out of debt, going back to school, or learning how to budget. Change does not happen overnight, therefore, SparkPoint OC commits to working with clients for up to 12 months to help them achieve their financial goals.

With the help of one-on-one financial coaching, attainable goal-setting plans are created in four key areas:

- Increasing income: free tax prep and tax credits, accessing public assistance, job training and placement

- Improving credit: establishing and managing credit

- Reducing debt: creating sustainable household budgets for greater financial freedom

- Building assets: savings and asset planning to help families reach goals such as buying a home or paying for college and establishing an emergency fund

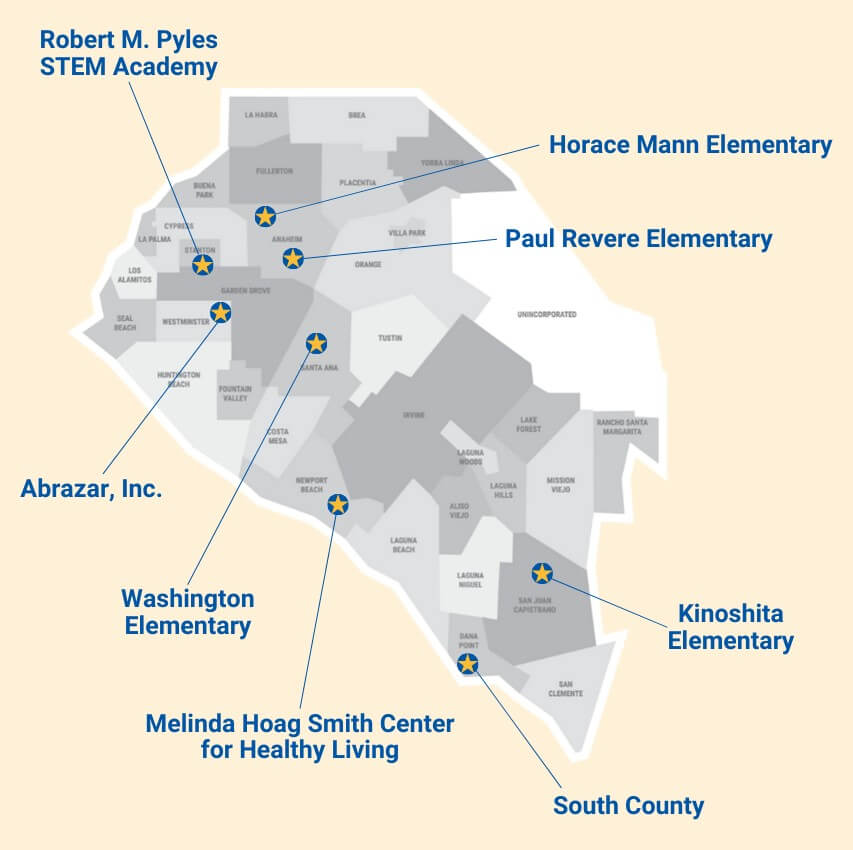

SPARKPOINT OC LOCATIONS

SparkPoint OC has been operating in Orange County since 2012. There are currently 8 locations throughout the county:

- Abrazar, Inc. (7101 Wyoming St., Westminster, CA 92683)

Serving families throughout the county

Email |714.278.4679 - Horace Mann Elementary in Anaheim

Serving families from 4 elementary schools in the district - Robert M. Pyles STEM Academy in Stanton

Serving families from 9 elementary schools in the district - Kinoshita Elementary

Serving families from schools in the Capistrano Unified School District - Melinda Hoag Smith Center for Healthy Living

Serving Orange County residents - Paul Revere Elementary in Anaheim

Serving families of students attending Paul Revere Elementary - South County (Virtual)

Serving South County residents - Washington Elementary in Santa Ana

Serving families of students attending Washington Elementary

For more information or to join the program, please contact the SparkPoint OC team.

FINANCIAL LITERACY WORKSHOPS

SparkPoint OC invites you to join us for a FREE Money Smart workshop series covering an array of financial literacy topics! From decreasing debt, increasing savings, budgeting, college planning, family vacations, and large purchases—it’s time to bring everything into focus and become a better steward of your finances.

Workshops are offered in both English and Spanish.

Please contact us at SparkPoint@UnitedWayOC.org to learn more.

SUCCESS STORIES

“SparkPoint OC is an amazing program. It changed our lives. I’m so excited for the future.”

–Tania, program graduate

HOW YOU CAN HELP

Provide financial support to add more SparkPoint OC financial empowerment centers in targeted OC neighborhoods.

CONTACT US

For more information, please contact the SparkPoint OC team.