SparkPoint OC Ignites Financial Empowerment

Thanks to the expansion of our SparkPoint OC financial empowerment centers, more families are getting the help they need to get back on track and stabilize their finances.

With the help of one-on-one coaching, attainable goals and financial plans are created in three key areas:

- Increasing income— accessing public assistance, job training and placement

- Managing credit—improving credit scores, managing debt, creating sustainable household budgets

- Building assets—savings and asset planning to help reach goals like buying a home or paying for college

In July 2016, SparkPoint OC hosted a graduation ceremony for 33 clients to celebrate their successful completion of the program. This group collectively: reduced their debt by $236,000, increased their credit score by 125 points, increased their income by 5% and increased their savings by $75,000.

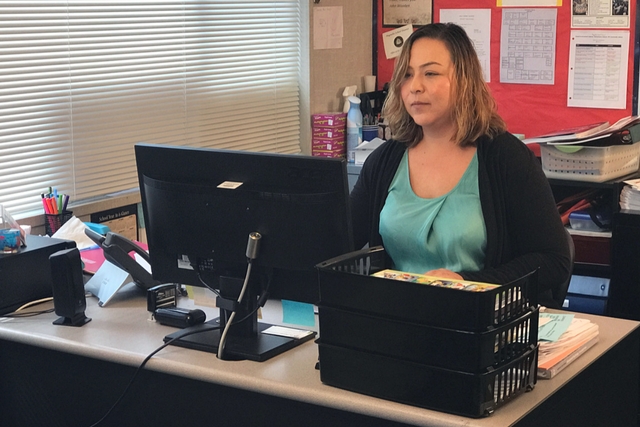

Recently we interviewed Ibet Villalpando, a case manager who works with families at local schools through SparkPoint OC. Thanks to SparkPoint OC more families are unlocking the possibilities to a more secure financial future that includes stable homes and thriving families.

To see Ibet in action and James, a recent SparkPoint OC graduate, enjoy these two short videos.